Land and buildings collection tool: guidance on leased assets

Updated 22 October 2025

Applies to England

As part of the consolidatedŌĆ»sector annual report and accounts for academies, the Department for Education (DfE) must follow IFRS 16 as part of its accounts preparation.

IFRS┬Ā16 is an international financial reporting standard for lease accounting. A lease under IFRS 16 is a contract that gives a lessee the right to use an identified asset (underlying asset) for a period of time in return for consideration.

To do so, we need to ask academy trusts for some extra details as part of the land and buildings collection tool (LBCT) return that is not included in the accounts return data we collect.

Academy trusts should follow the accounting standards as set out in theŌĆ»academy accounts direction. You do not need to apply IFRS 16 as part of your accounts preparation.┬Ā

All data previously collected will be pre-populated as part of your following yearŌĆÖs LBCT return.

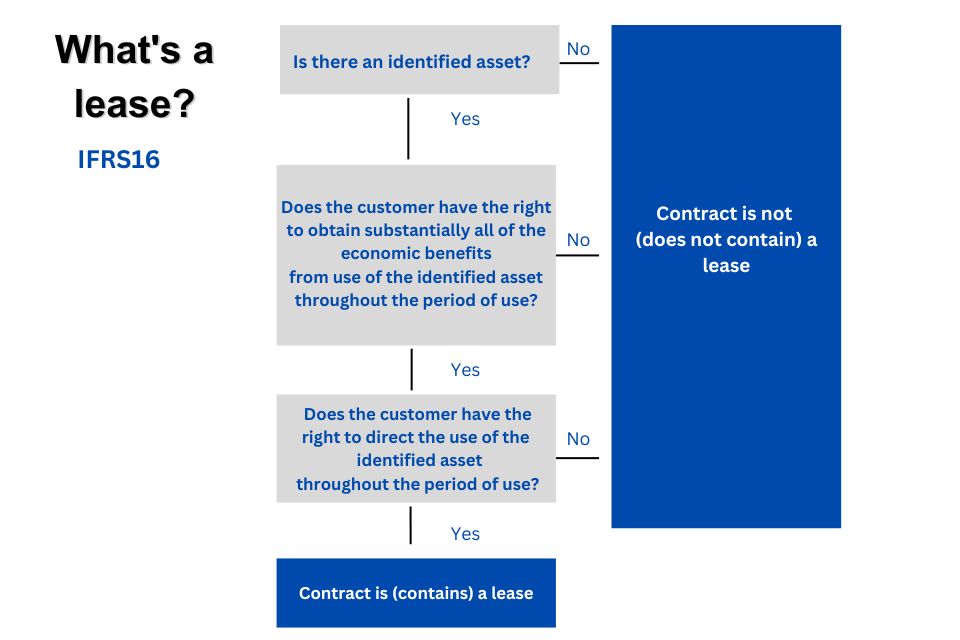

What a lease agreement is

To be classified as a lease under IFRS 16, your contract must meet certain criteria. Those criteria are that you have the right to:

- obtain substantially all the economic benefits from your use of the identified asset throughout the period youŌĆÖll be using it

- direct the use of the identified asset (underlying asset) throughout the period of use

If both of these criteria are met, your contract is a lease. If they are not, it is not a lease.

To understand how this would look in the form, refer to example scenario 1.

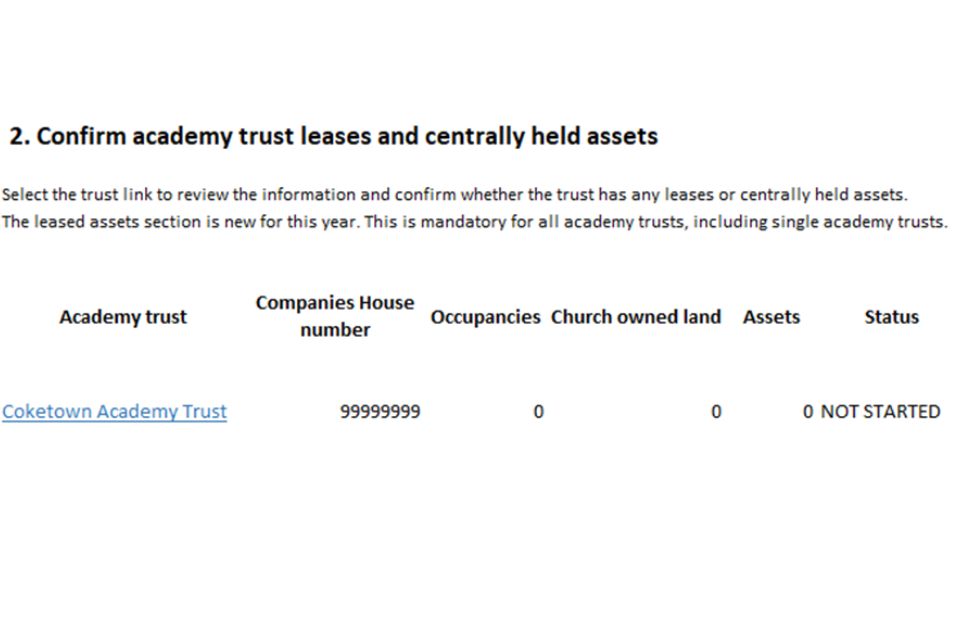

How we collect this information

The information is collected via the leased assets section in the academy trust leases and centrally held assets section of the LBCT form:

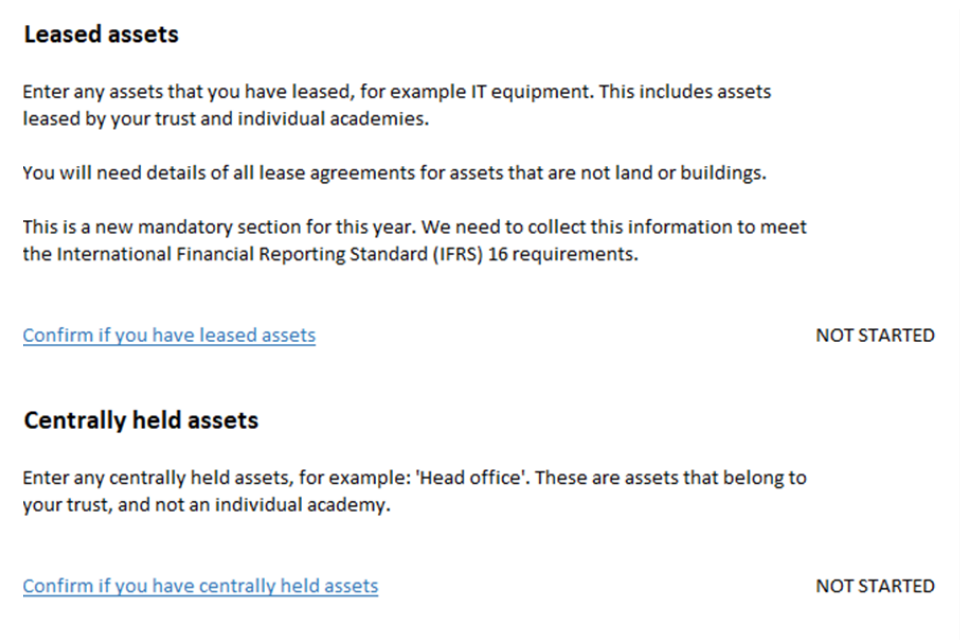

When you select the hyperlinked name of the trust, you are taken to the next page, which displays the leased assets and centrally held assets sub-sections.

Select the ŌĆśConfirm if you have leased assetsŌĆÖ link and work through the pages to provide information about any leased assets you may have, both at trust and academy level.

Information you need to provide

Before starting, we recommend you watch or listen to the . If you experience issues in playing the video, check you allow cookies on ę┴╚╦ų▒▓ź.

You need to tell us about any leased tangible assets you have at 31 August 2025 that are not land and buildings, at both academy and trust level.

For some asset categories deemed to be low-value assets, we only require the number of lease contracts held per category at trust or academy level.

The diocesan checker is not required to review any of the information entered in the leased assets section of your return.

Asset categories included

We recommend you watch or listen to the . If you experience issues in playing the video, check you allow cookies on ę┴╚╦ų▒▓ź.

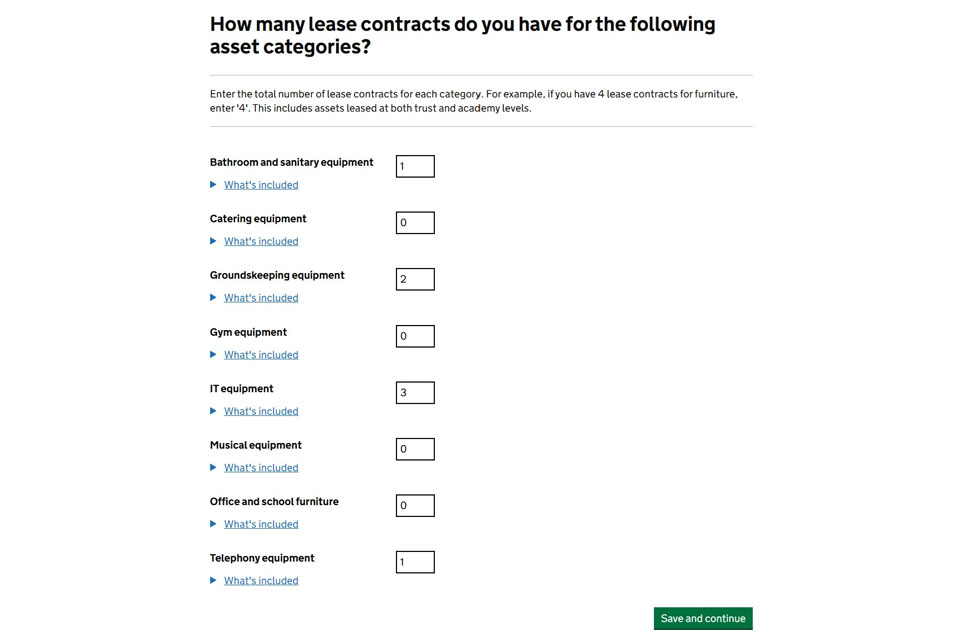

For the asset groups in the table below, you only need to tell us how many leased asset contracts are in place at 31 August 2025 across your whole trust.

You do not need to tell us the number of assets or who uses them (that is, the trust, its academies or both). You do not need to upload copies of the agreement for these categories.

| Asset category | WhatŌĆÖs included |

|---|---|

| Bathroom and sanitary equipment | Hand dryers, towel dispensers, sanitary bins |

| Catering equipment | Tills, water coolers, vending machines, dishwashers, washing machines, ovens, fridges, freezers, water boilers, small kitchen appliances (toasters, coffee machines, microwaves, kettles etc), crockery and cutlery |

| Furniture | Tables, chairs, benches, desks |

| Groundskeeping equipment | Lawn mowers, string trimmers, leaf blowers, salt spreaders |

| Gym equipment | Treadmills, free weights and weight machines, rowing machines, exercise bikes |

| IT equipment | Laptops, tablets, desktop computers, printers, photocopiers, servers, door-entry security systems, CCTV systems, whiteboards and touch-screen boards, franking machines |

| Musical instruments | Orchestral equipment, keyboards, guitars |

| Telephony | Mobile phones, landline phones, telephone systems |

As an example, if you have one lease for 300 laptops and one lease for 25 whiteboards, enter 2 leases in the IT equipment category. Similarly, if you have one contract for lawnmowers, string trimmers and salt spreaders, enter 1 in the groundskeeping equipment category. If you do not have any lease contracts for the specified category, enter 0.

If you have leased software, intellectual rights for teaching materials or any other type of intangible assets, such as music performance rights, these are excluded from this collection.

Vehicles and other leased assets

We recommend you watch or listen to the . If you experience issues in playing the video, check you allow cookies on ę┴╚╦ų▒▓ź.

If youŌĆÖve leased any type of vehicle, or have another type of asset that does not fit into any of the categories listed above, youŌĆÖll need to provide more details about the contracts for those leases.

YouŌĆÖll only need to upload the individual lease agreement documents for the vehicle and other leased asset categories.

These documents:

- can be in .pdf, .jpeg, .gif or .png format

- must be less than 23MB in size

The following are examples of whatŌĆÖs included in these 2 categories.

| Asset category | WhatŌĆÖs included |

|---|---|

| Vehicles | Minibuses, quad bikes, coaches, buses or cars |

| Other | Wind turbines, LED lighting systems, EV charge stations, etc |

WeŌĆÖll ask you for:

- the number of assets included in the lease contract (note: if you lease 10 assets in one lease contract, you only need to provide the details once)

- a description of what you lease

- a description of who uses the assets (that is, trust only, trust and academies, multiple academies or a single academy)

- your monthly lease payment (excluding VAT)

- the lease┬Āstart and end dates

- the lease┬Āagreement document

Agreements for printers, or any other similar device, fall into the IT equipment category, for which no agreement evidence needs to be uploaded.

When all leased assets have been added, check the information via the summary review page. At this stage, you can still edit and delete data.

Once confirmed, the status of the leased assets section will change to ŌĆśCompletedŌĆÖ on the trust index page.

When the status of both the leased assets and centrally held assets sections on the trust index page is showing as ŌĆśCompletedŌĆÖ and youŌĆÖve completed a final review, select ŌĆśSend to approverŌĆÖ.

The status of the trust link in the ŌĆśConfirm academy trust leases and centrally held assetsŌĆÖ section on the dashboard will then change to ŌĆśSent to approverŌĆÖ.

Service agreements

There may be instances where a leased asset includes a service agreement ŌĆō for example:

-

you lease an industrial grass cutter and, as part of the agreement, the grass is cut and applications of herbicide for weed control are included

-

you lease a vehicle and the lease includes free servicing

In these instances, enter the lease details in the relevant category and include a brief description of the service agreement in the lease description comments box.

Other scenarios

Salary sacrifice car scheme

If your trust has a salary sacrifice electric vehicle (EV) car lease scheme, where employees lease a car using the trustŌĆÖs lease-car supplier, the monthly lease rental payments are collected from their salary and paid to the lease company by the trust.

In this instance, the employee is the lessee and the lease company is the lessor. The trust itself is not a lessee and does not need to tell us about vehicles provided to employees under this arrangement. More information is available in section 2.31 of the academy trust handbook

Smart meters

If a utility company provides your trust or academy with smart meters as part of the service it delivers, these are usually owned by the utility company, which has the right to remove them when a trust or academy changes provider.

You do not have to pay any charge for their use and, as such, there is no lease arrangement in place, so trusts do not need to tell us about their smart meters.

Solar panels

Your academy may lease out space on its roof to a third party that then installs solar panels.┬ĀIn this instance, the academy is acting as a lessor and would be required to report a sub-lease in the buildings section of the LBCT return. You do not have to report this arrangement in the leased assets section of the form.

Only in the instance that your academy has leased a solar panel from a third party and had it installed on its roof would you need to include this. This would need to be included in the leased assets section, in answer to the question ŌĆśHave you leased any other assets that do not fit into the previous categories?ŌĆÖ

Purchase of a leased asset

If you had a lease for an asset that you subsequently purchased outright before 31 August 2025, this does not need to be recorded in your return. We only require information about any assets you were leasing at 31 August 2025.

If youŌĆÖre not sure whether to report a leased asset, we recommend you include it and provide a meaningful description. If you need further help, contact us via the .

You can see examples of how to deal with leased assets in the case studies╠²▓§▒│”│┘Š▒┤Ū▓į.

Uploading lease agreements

We recommend you watch or listen to the . If you experience issues in playing the video, check you allow cookies on ę┴╚╦ų▒▓ź.

Copies of lease agreements will only be required for the vehicles and other leased assets categories.

If you experience any issues in uploading the documents, check that:

- theyŌĆÖre in the right file format: .pdf, .jpeg, .gif or .png

- the file size is smaller than 23MB

If you still experience difficulties uploading the documents, contact us via the .

Case studies

Academy trusts must provide details of all lease agreement for assets that are not land or buildings. WeŌĆÖll use the fictitious Coketown Multi-Academy Trust as an example.

Example scenario 1

Coketown Multi-Academy Trust is made up of 11 academies. It has non-land and buildings asset contracts at both trust and academy levels, with leases for:

- lawn mowers

- salt spreaders

- laptops, tablets and desktop computers

- photocopiers

- whiteboards

- mobile phones

- hand dryers, towel dispenser and sanitary bins

How to record this on the LBCT

On the non-land and building assets contract page, in response to the question ŌĆśHave you leased any assets that are not land or buildings?ŌĆÖ, answer ŌĆśYesŌĆÖ and complete the next section, which asks, ŌĆśHow many lease contracts do you have for the following asset categories?ŌĆÖ

Enter a number for each asset - for example, lawn mowers and salt spreaders are both in the groundskeeping equipment category, so youŌĆÖd enter 2.

Example scenario 2

Coketown Multi-Academy Trust is made up of 11 academies. It has non-land and buildings asset contracts for both trust and academy levels, with leases for:

- treadmills, free weights, weight machines, rowing machines

- tables

- franking machines

- kitchen appliances

- orchestral equipment

- vehicles

- EV charging equipment

How to record this on the LBCT

Record the first 5 contracts as┬Āfor example scenario 1.

You will then be asked if you lease any vehicles. This includes minibuses, coaches, buses and cars. Answer ŌĆśYesŌĆÖ and complete the questions on the┬Ānext page.

You will then be asked if you lease any other assets that do not fit into any of the previous categories. Again, enter ŌĆśYesŌĆÖ and complete a similar set of questions for the EV charging equipment.

How to contact us if you have queries

If you have any questions about the┬ĀLBCT┬Āreturn, you can contact us via the .